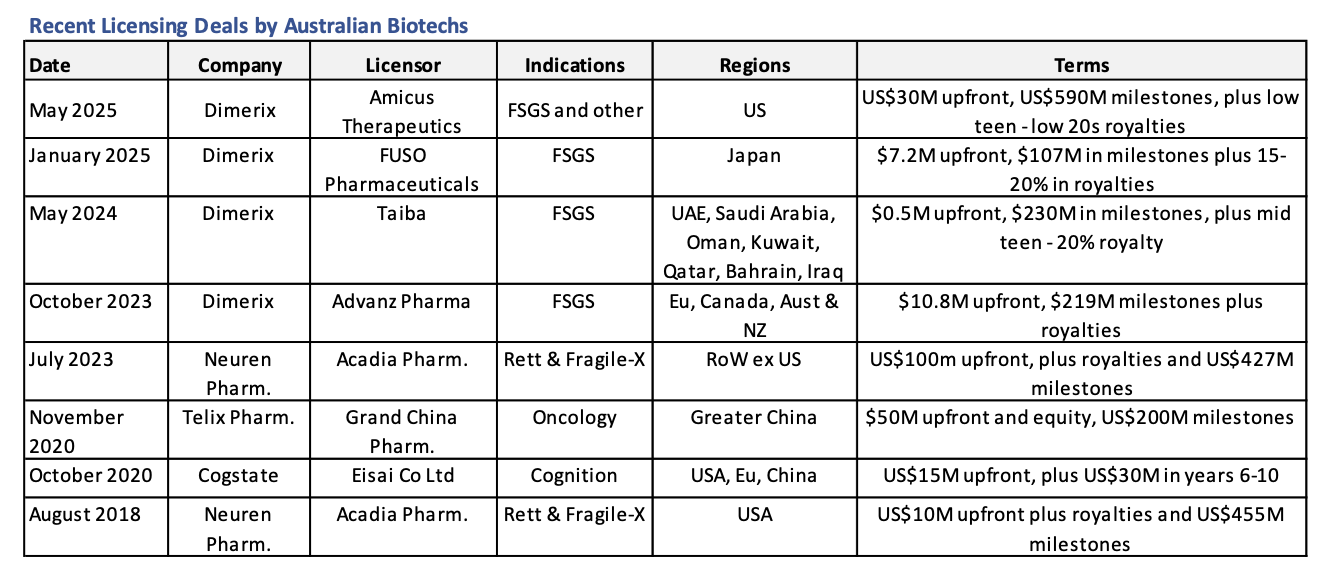

At the Bioshares Biotech Summit in Hobart two years ago, Dimerix (DXB: $0.66) presented in the session titled 'Finding the Next Neuren.' Recently, Dimerix announced its fourth and most significant licensing deal—with Amicus Therapeutics in the US. This deal arguably sets the company on course to follow in the footsteps of the highly successful Neuren Pharmaceuticals.

Ten-Figure Trajectory

The deal grants Amicus rights to Dimerix's lead compound in development, DMX-200, for the treatment of the orphan kidney disease FSGS in the US, and for all other potential indications.

Dimerix has already received a $48 million upfront payment (US$30 million), with additional development success payments of $119 million (US$75 million) up to and including FDA approval. A further $56 million (US$35 million) is due once first sales are achieved, and up to an additional $653 million (US$410 million) will be paid upon reaching certain sales milestones for DMX-200.

The total potential value of the deal is up to $1.4 billion. Dimerix will also receive royalties from net product sales, starting in the low teens and peaking just over 20%.

DMX-200 is currently undergoing a Phase III global study aiming to recruit 286 patients. So far, 185 patients (65%) have been enrolled. All participants—both in the control and active treatment groups—are being offered the opportunity to continue or begin treatment with DMX-200 in an open-label extension phase. So far, 42 patients have moved into the extension phase.

Dimerix ended March with $17 million in cash. It is still due to receive $4.1 million from its Japanese partner Fuso once the first clinical site in Japan opens (expected shortly), $48 million from Amicus, and $6.3 million from options. This brings the total available funding to approximately $75 million, which provides 4.2 years of operational runway.

Amicus Therapeutics

Amicus is a US biotech company specializing in rare diseases. Its lead product, Galafold, is used to treat Fabry disease and was approved in 2018. Last year, Galafold generated US$458 million in sales.

Its second product, a combination therapy called Pombiliti and Opfolda for Pompe disease, was approved in September 2023. Sales for this combination therapy totaled US$70 million last year. Given that Dimerix's therapy is also a combination (DMX-200, a CCR2 inhibitor, combined with the current standard-of-care angiotensin receptor blocker or ARB), Amicus's expertise in this area is a strong strategic fit.

In total, Amicus generated US$528 million in sales last year, an increase of 32%, but recorded a net loss of US$56 million. The company ended the year with US$250 million in cash. The licensing deal with Dimerix will be paid from these existing cash reserves. Amicus is capitalized at US$1.8 billion.

FDA Ruling

A significant recent development was the FDA ruling suggesting that changes in proteinuria levels could serve as the basis for full approval of DMX-200 for treating FSGS.

This aligns with what Dimerix has been seeking. The company believes that changes in proteinuria are more accurate than eGFR, which has historically been used as a primary endpoint in kidney disease studies.

The agreement may also allow Dimerix to select two different outcome measures, including the number of patients achieving a certain reduction in proteinuria (e.g., to 0.7g/g) or the percentage change in proteinuria after two years of treatment.

This agreement gives Dimerix added flexibility in a disease area where there are currently no approved therapies, affecting both adults and children.

Accelerated Approval

Will Dimerix still pursue Accelerated Approval? That will depend on the outcome of Project Parasol, which is working to identify a suitable endpoint for accelerated (earlier) approval of DMX-200. It is expected to take three to six months for the group to deliver a recommendation or decision relevant to Dimerix's current study.

Dimerix is currently capitalized at $368 million.

Bioshares Recommendation: Speculative Buy Class A

Disclaimer:

Information contained in this newsletter is not a complete analysis of every material fact respecting any company, industry or security. The opinions and estimates herein expressed represent the current judgement of the publisher and are subject to change. Blake Industry and Market Analysis Pty Ltd (BIMA) and any of their associates, officers or staff may have interests in securities referred to herein (Corporations Law s.849). Details contained herein have been prepared for general circulation and do not have regard to any person’s or company’s investment objectives, financial situation and particular needs. Accordingly, no recipients should rely on any recommendation (whether express or implied) contained in this document without consulting their investment adviser (Corporations Law s.851). The persons involved in or responsible for the preparation and publication of this report believe the information herein is accurate but no warranty of accuracy is given and persons seeking to rely on information provided herein should make their own independent enquiries. Details contained herein have been issued on the basis they are only for the particular person or company to whom they have been provided by Blake Industry and Market Analysis Pty Ltd. The Directors and/or associates declare interests in the following ASX Healthcare and Biotechnology sector securities: Analyst MP: 1AD, ACR, AVR, CGS, CUV, CYC, DXB, IMM, LBT, MX1, OPT, NEU, PAB, PXS,RNO,SOM. These interests can change at any time and are not additional recommendations. Holdings in stocks valued at less than $100 are not disclosed.