For Botanix Pharmaceuticals (BOT: $0.15) the priority is to reach profitability from existing funds as it accelerates sales from its newly-launched drug Sofdra, for the treatment of excessive underarm sweating (primary axillary hyperhidrosis).

The first prescriptions for the product were recorded in December last year. The company has had a strong start, with 3,222 prescriptions in the March quarter, increasing to 13,647 in the June quarter. This included 5,570 prescriptions in June alone, up 21% on May.

The number of doctors prescribing the product has also risen quickly, from 1,075 at the end of March to 2,314 at the end of June.

Numbers of new patients adopting the therapy have also been strong, with just under 3,000 in the March quarter, and increasing to just over 7,000 in the June quarter. CEO Howie McGibbon said that the vast majority of patients are continuing with the treatment.

Funding

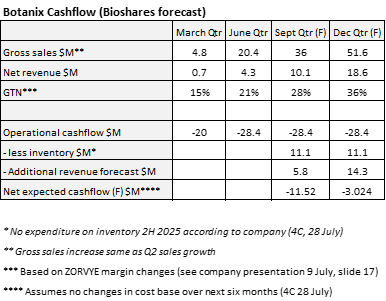

In the June quarter, the company spent $11.1 million on inventory, with a total cash outflow from operations of $28.4 million for the quarter. No additional inventory spend is expected in the current half. Botanix recorded $4 million of receipts from product sales and royalties ($195,000, from sales in Japan, via licensee Kaken Pharmaceuticals).

The company finished June with $65 million in cash, having conducted a $40 million capital raise in April this year at $0.33 per share, and having accessed a net $28 million of debt funding.

The company's cash burn is expected to decrease substantially this quarter, with no investment in inventory required (8-12 months of stock), and sales likely to continue to accelerate. The company's net margin will also improve, with the "gross to net" (GTN) flowthrough being 23% in June. This accounts for rebates to patients and payors, as well as wholesale distribution costs.

Breakeven Within Sight

Botanix is aiming for its GTN yield to increase to between 30%-40%, in line with the industry standard. In the March quarter, the GTN figure was just 14.5%, increasing to 21.5% in the June quarter, and 23% in the month of June.

This can be expected to increase in coming quarters, as the early discounts reduce, and as patients' deductibles limits are reached. In order to access the market quickly, Botanix offered a "zero-dollar copay" program, and launched its own online portal for in-house distribution.

If gross revenue expands by the same dollar amount in each of the next two quarters, and the GTN percentage increases to 28% and 36% (see product example provided by Botanix, 9 July 2025), then we forecast just a $3.3 million cash outflow from operations in the December quarter.

Change in Sales Spend

When Botanix launched its drug, it selected two approaches, one being through a telehealth platform, and the second being with a direct field force. The company has quickly found that revenue generated from direct sales force is more predictable and reliable (with respect to costs and profitability for each salesperson).

The telemarketing approach takes more time to assess and to penetrate the market. CEO McKibbon said that digital (telemedicine) sales represent a larger upside over the long term, but it is difficult to predict the return on investment at this point. Conversely an on-the-ground sales force is more predictable, with the focus being to bring the company to a cashflow positive point with existing funds, which McKibbon believes is achievable.

As a result, the company will be directing its sales and marketing budget to the direct salesforce. In the June quarter, the company added seven more sales reps for a total of 33, with an additional 17 to be hired this quarter.

Botanix Pharmaceuticals is capitalized at $294 million.

Bioshares recommendation: Speculative Buy Class A

Disclaimer:

Information contained in this newsletter is not a complete analysis of every material fact respecting any company, industry or security. The opinions and estimates herein expressed represent the current judgement of the publisher and are subject to change. Blake Industry and Market Analysis Pty Ltd (BIMA) and any of their associates, officers or staff may have interests in securities referred to herein (Corporations Law s.849). Details contained herein have been prepared for general circulation and do not have regard to any person’s or company’s investment objectives, financial situation and particular needs. Accordingly, no recipients should rely on any recommendation (whether express or implied) contained in this document without consulting their investment adviser (Corporations Law s.851). The persons involved in or responsible for the preparation and publication of this report believe the information herein is accurate but no warranty of accuracy is given and persons seeking to rely on information provided herein should make their own independent enquiries. Details contained herein have been issued on the basis they are only for the particular person or company to whom they have been provided by Blake Industry and Market Analysis Pty Ltd. The Directors and/or associates declare interests in the following ASX Healthcare and Biotechnology sector securities: Analyst MP: 1AD, ACR, AVR, CGS, CYC, CYP, CUV, CC5, DXB, IMM, MX1, NEU, PAB, SNT, CHM, ATX. These interests can change at any time and are not additional recommendations. Holdings in stocks valued at less than $100 are not disclosed.